Your lead scoring model isn’t broken—it’s just incomplete.

Whether you’re putting the finishing touches on your model by hand or letting a predictive algorithm do the heavy lifting, we all have the same goal: Help sellers work smarter, not harder.

But if your lead scoring is based on limited insights, it’ll provide limited value.

Keep reading to learn:

- What your lead scoring model is missing

- Why you should expand your view of prospects

- How to give your lead scoring model an upgrade

What’s missing from your lead scoring model

Lead scoring—the act of assigning point values to leads so we can prioritize the best opportunities—is woven into the fabric of go-to-market strategy.

It’s not just how we take a prospect’s temperature—it’s how we inform our approach to planning, triaging, and more.

That means our lead scoring models—the systems we use to decide how points are assigned to leads—deserve some TLC.

Which begs the question: Why do so many models stop at the same old criteria?

You know the usual suspects: web page visits, email opens, content downloads, event registrations, demo requests.

The answer is simple: Because those are the data points we have access to.

It’s not that this data isn’t valuable—some of it is. But it only shows you a small slice of the customer journey.

Sure, more advanced organizations will deploy predictive models to assign scores based on historical data. There’s a slew of tools out there that help you tweak lead scores based on past performance.

But at the end of the day, your model is only as good as the data at your fingertips. If a partial view of your customer powers your lead scoring model, the output is only partially better than gut instinct.

So scores get tallied up, a certain threshold is reached, and you pass along the “hot” lead to sales. Then they hop on a call only to discover that the lead isn’t interested, isn’t ready, isn’t the right fit, or hasn’t even heard of you.

And that’s if the lead shows up in your model at all.

Modern buyers actively avoid taking actions that will result in getting solicited by sales teams. They’re not visiting your website and filling out a form—at least not at first. They’re kicking tires via open source and product trials, making moves in user communities, sourcing recommendations on social, and asking questions in online forums.

Even if someone signs up for a free trial of your product, there’s a good chance they’re using a personal email address to test it out. How are you supposed to create a product-qualified lead when you can’t layer on firmographics like what they do or where they work? No sales team wants to work a lead that doesn’t reach the right ICP threshold.

Lead scoring models are based on the data you have on hand. They fail because you can’t track your customers where they spend most of their time: the dark funnel.

Building a better lead scoring model

Upgrading your lead scoring model isn’t about reinventing the wheel—it’s about expanding the attributes and actions you’re pulling in.

Let’s use data activation platform (and Common Room customer) Census as an example of what we mean:

Identity

Anonymous signals are weak signals. You don’t just want to know what someone did—you want to know exactly who that someone is.

Census brings together digital interaction data from across channels and uses artificial intelligence to resolve identities and create unified profiles of leads.

It can see the real people behind the leads it's scoring (and the real organizations they’re associated with).

🎤 “Enhancing lead scoring with signals from community, social, and other digital channels gives us a more complete understanding of each user as they move through their customer journey with Census.”

—Allie Beazell, Marketing Chief of Staff and Director of Developer Marketing at Census

Intent

Activity across owned properties is important, but it’s only one piece of the puzzle. You want to uncover buyer intent data from across all the digital watering holes your leads frequent.

Census does this by tracking dark-funnel conversations and activities and then combining it with the marketing engagement data already stored in its CRM.

This helps the company pick up on intent signals it may have otherwise missed and add key context to its lead scoring model.

Fit

High-intent activity only matters when it’s associated with a high-fit prospect. And you want to see every lead who matches your ideal customer profile (ICP), not just the ones your data intelligence platform can find.

Census automatically tags and tracks activity across channels among individuals who fit its ICP and uses AI to merge and deduplicate profiles for better accuracy.

The company can make sure its lead scores account for all relevant demographic and firmographic details across a wider pool of prospects.

🎤 “The insights brought together by Common Room ensure our team can engage with the right person at the appropriate time with an offer that truly aligns to their needs.”

—Allie Beazell, Marketing Chief of Staff and Director of Developer Marketing at Census

The result is more leads and more comprehensive lead scoring, both of which boost sales velocity.

🎤 "We're able to show how our programs have engaged over half of our closed pipeline while also speeding up deal time to close by 40%."

—Allie Beazell, Marketing Chief of Staff and Director of Developer Marketing at Census

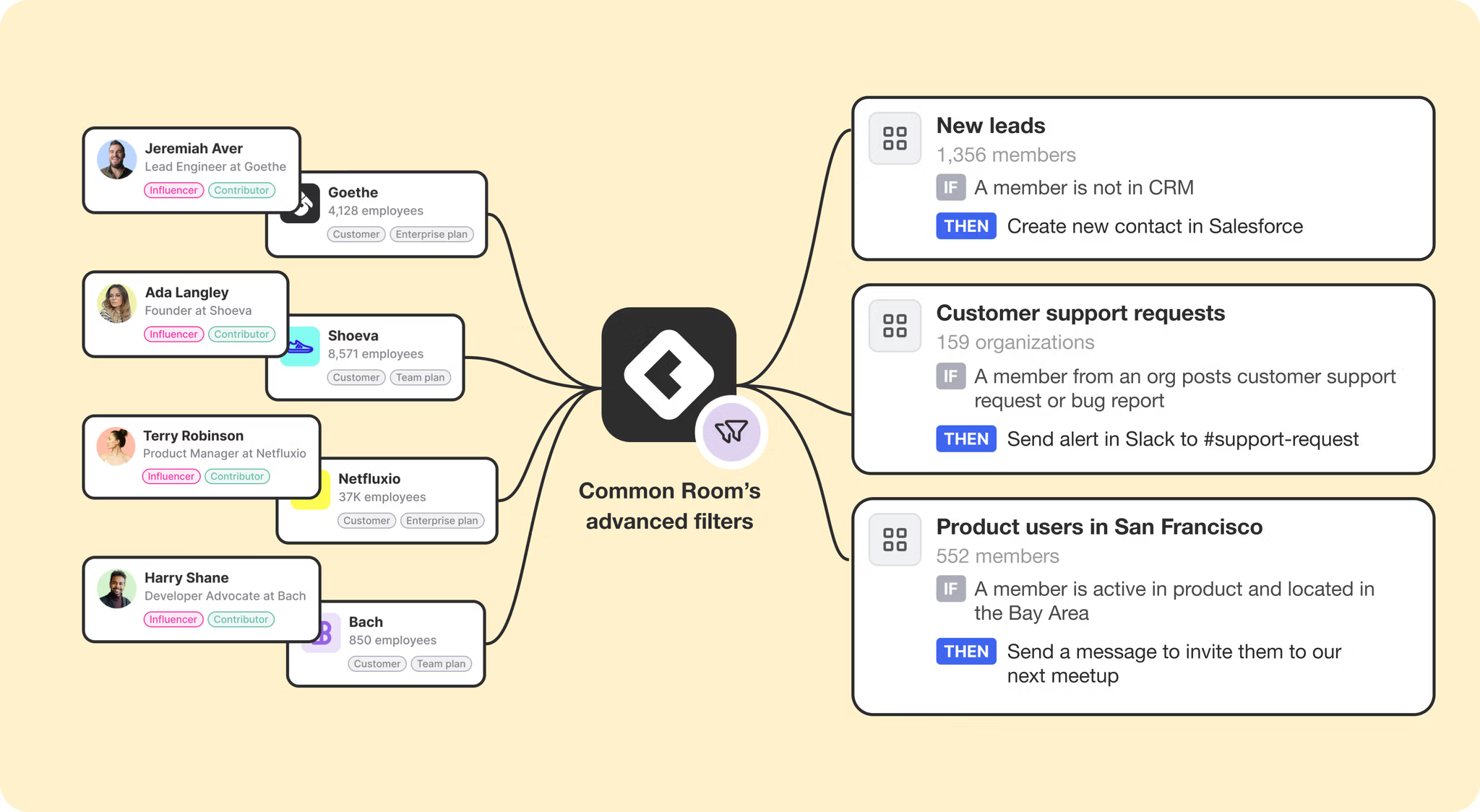

How Common Room helps you connect the dots

Common Room centralizes all traceable digital activity from across your customer touchpoints and reveals the people and accounts behind it.

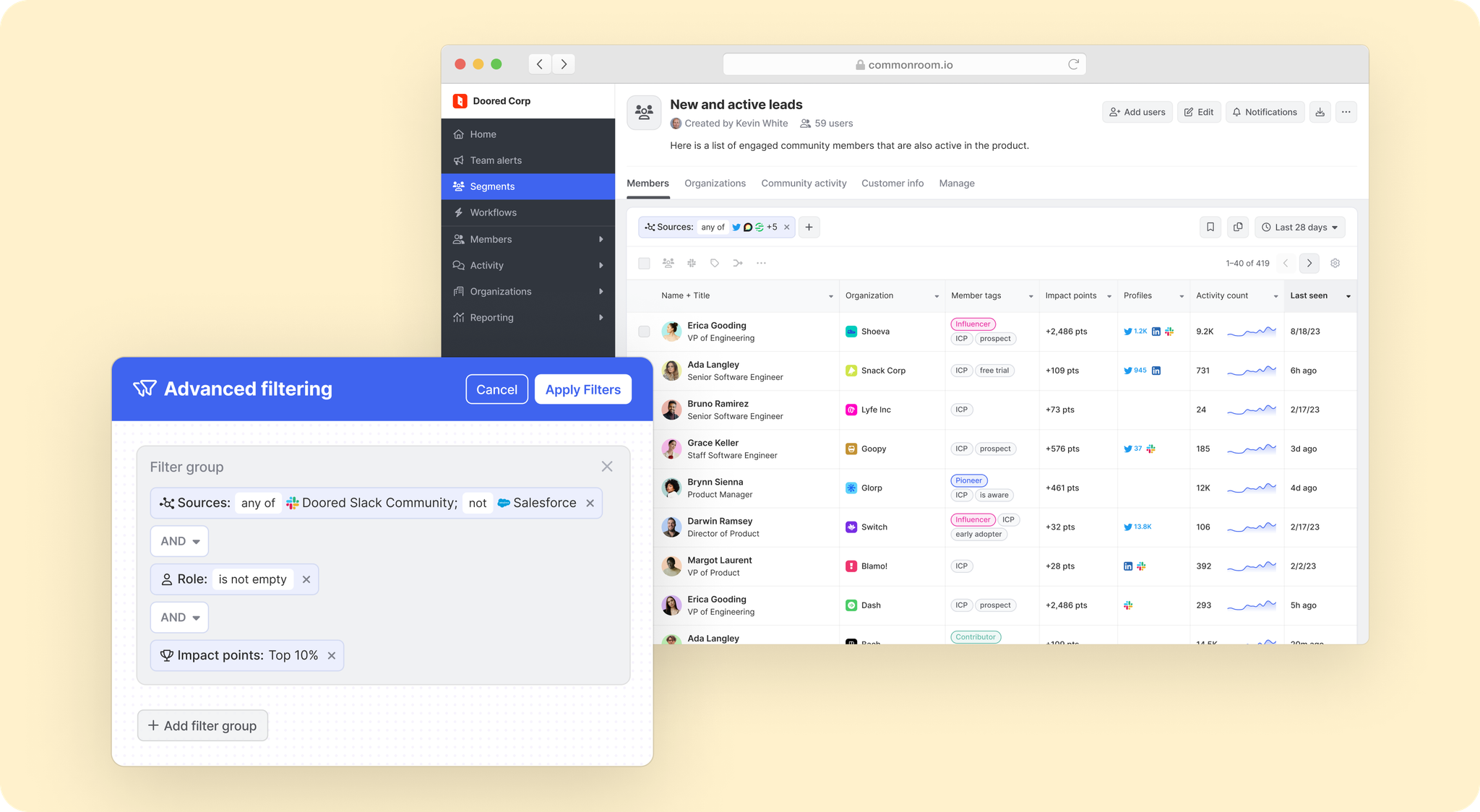

Dozens of natively built and fully managed integrations with dark-funnel channels (along with our API and support for webhooks, Zapier, and CSV imports) allow you to pull your digital interaction data into one place and combine it with the data recorded in your product and CRM.

AI-powered identity resolution and profile enrichment creates a detailed profile of every individual interacting with your company across channels (as well as where they work and how to contact them).

You can then create a two-way integration with your CRM of choice. This allows you to view digital engagement data in your CRM (as well as push community-qualified leads to it) and view the customer data you already have within Common Room.

This bidirectional integration makes it easy to connect the lead scoring dots in your CRM with the insights uncovered in Common Room.

Once you know the person behind the behavior, you can use filters in Common Room to zero in on high-intent activities, layer purchase intent over customer fit, and dig into where leads are in the buying cycle based on their histories across dark-funnel channels.

But it doesn’t stop at lead scoring. From here, you can create segments of high-intent, high-fit leads for sales to follow up on. Customizable alerts allow you to stay notified of activity among leads and automated workflows make it easy to organize and engage leads at scale.

A good lead scoring model is the gift that keeps on giving: more revenue, less wasted time, and a stronger partnership between marketing and sales.

Common Room helps GTM teams create higher-converting pipeline and close deals 20% faster by providing them with the full picture.

Build a better lead scoring model with Common Room

Ready to see how Common Room helps you separate the best opportunities from the rest?