When you compare product-led sales (PLS) to enterprise sales, what you’re really looking at is the evolution of B2B SaaS.

For many organizations, the “traditional” sales process has morphed into a combination of self-service and human touch. Marketing-qualified leads give way to product-qualified leads and top-down sales motions get replaced with bottoms-up business models.

But if you want to land higher annual contract values, you have to break into enterprise accounts.

And product-led companies are discovering that product usage won’t give them everything they need to close larger deals.

Keep reading to learn:

- Why a product-led approach won’t help you climb the enterprise hill

- What’s stopping product-led companies from making the move upmarket

- How to get truly data-driven with your sales process

A tale of two sales strategies: product-led vs. enterprise

Sales is sales, but it’s hard to imagine two strategies more dissimilar than product-led and enterprise.

Product-led (aka bottoms-up)

Product-led sales has its roots in product-led growth (PLG). You can think of it as a hybrid of PLG and traditional sales models.

Product users show initial intent by signing up for a free trial or freemium plan. Then, based on this signal and their continued product usage, sales teams move in to sell them (and their boss if the end user isn’t the decision-maker) on the paid product.

These deals are generally more transactional—users are looking to solve a specific problem and your product (fingers crossed) fits the bill.

Enterprise (aka top-down)

Enterprise sales isn’t about selling an end user—it’s about selling an entire company. And that means the job titles involved are higher up the ladder.

Reps research and prospect target accounts. They hold discovery calls and explore organizational pain points. They show off solutions, answer questions, and double down on outcomes instead of product features.

This means enterprise sales cycles are longer and more involved. Sellers pitch buying committees instead of individuals. And there’s a lot more room for roadblocks (multi-year contract negotiations, bespoke implementation requests, stringent security requirements—you get the idea).

Why product-led companies have their eyes on the enterprise

Product-led companies inevitably try to move upmarket (69% of today’s fastest-growing product-led organizations have an enterprise offering).

Starting with a fully self-service business model is a cost-effective way to create a customer base, but you can’t scale revenue on credit card transactions alone—not predictably and sustainably, at least.

Plus, PLG companies have lower conversion rates than their sales-led counterparts.

Most organizations eventually hire sales reps to complement their product-led motion. This helps them close bigger and better deals that require the white-glove treatment.

But unless you keep winning larger, longer-term deals, your revenue growth hits a hard ceiling.

Enterprise sales is the logical next step. It’s a knottier sales process, but it holds the potential for much larger deal sizes.

What's keeping PLS companies from moving upmarket

PLS companies want to go bigger, but they find themselves in a pickle when they try to apply a product-led approach to enterprise sales. And it all comes down to data.

Insights are out of reach

Sales teams are already struggling to get access to and make sense of product data.

Product usage signals are usually siloed across different tools. Reps are forced to spelunk through dashboards and spreadsheets that weren’t designed for them and their workflows in order to surface relevant insights.

If they’re lucky enough to get their hands on product data in the first place, they’re left with hard-to-decode intent signals that are missing key details. Half the time people are signing up for product trials with personal email addresses instead of company handles. And then reps have to push this information to yet another tool to take action on it.

Every minute not spent selling equals lost sales productivity.

Buyer context is missing

Product data isn’t enough signal on its own.

End users aren’t usually the people who sign an annual agreement. If sellers see someone from an enterprise account giving their product a test drive, they have to be prepared to multi-thread their way through various stakeholders to reach decision-makers.

Product usage alone won’t tell reps which teams they need to win over, who the economic buyers are, and what messaging will resonate most.

Besides, many enterprise companies may discourage employees from even trialing a product due to security concerns (one reason for all those sign-ups with personal email addresses). It’s not uncommon for enterprise organizations to book multiple demos and get a contract in place before even signing up for a free trial.

While a product-led approach is straightforward (in theory, at least), enterprise sales is a more intricate, high-touch process.

To bridge the gap, companies have to go beyond product-led sales tactics and get truly data-driven.

How to turn reps into enterprise champions with Common Room

Enterprise sales isn’t a numbers game (spray-and-pray messaging need not apply)—it’s a performance game. And it’s fueled by buyer identity, intent, and context.

Common Room is designed to put these insights directly into sellers’ hands. Here’s how:

Make relevant data readily available

Reps don’t just need product signals—they need every buying signal related to an organization and its employees.

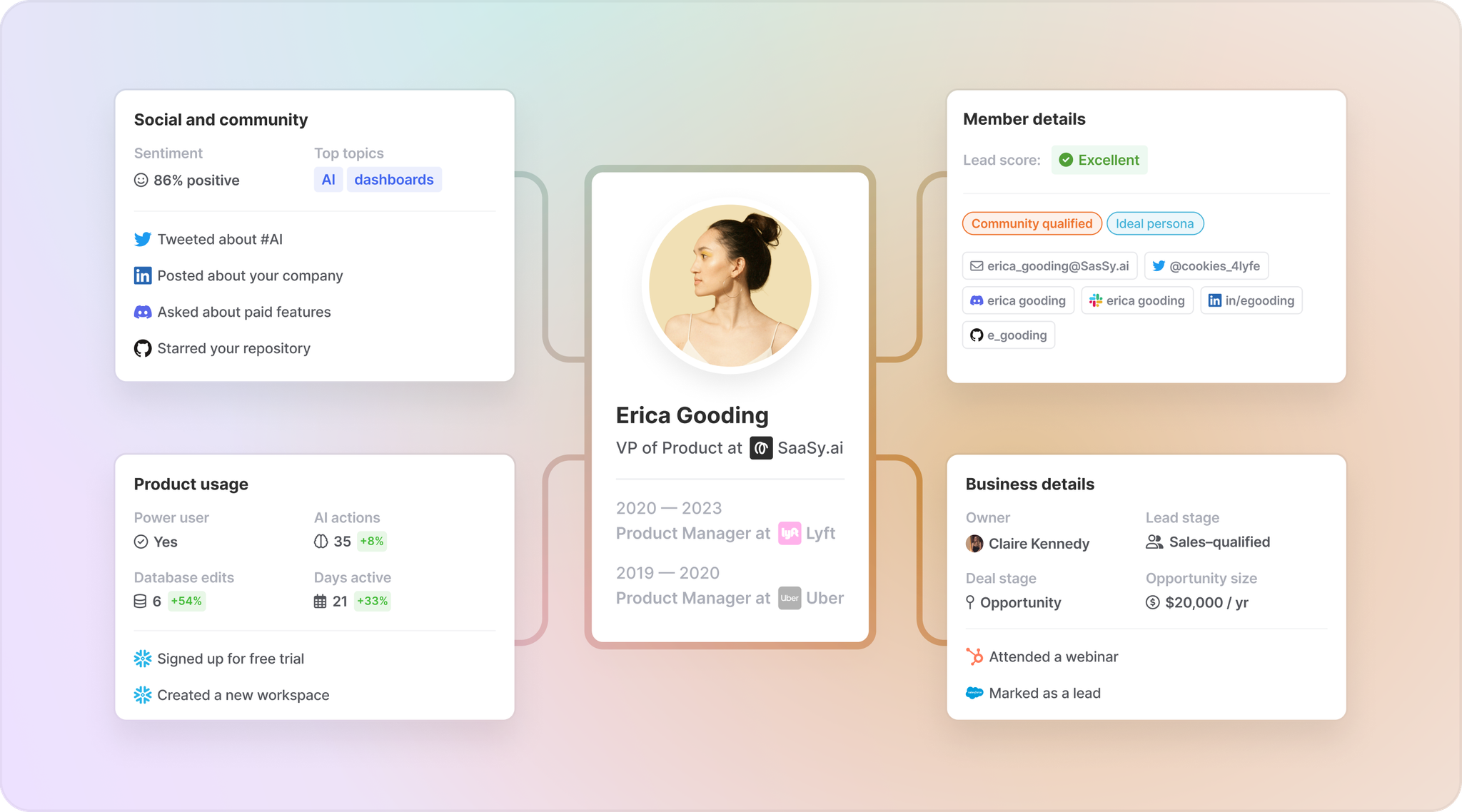

Common Room’s natively built and fully managed integrations allow you to centralize insights from every data source that matters—social channels, community forums, your product, your CRM, and more—and combine them to reveal the people and organizations behind the signals.

AI-powered identity resolution and enrichment automatically create a unified profile for individuals and their companies, enabling sales teams to prioritize and personalize outreach based on cross-channel activity, product usage, buying power, and much more.

🎤 "Common Room gives our go-to-market team members daily feeds of users showing intent across multiple channels—all in one place. Over 50% of our meetings come from Common Room."

—Tim Hughes, Vice President of Sales at Temporal

Make sales insights sales-friendly

It’s not enough to equip sales reps with data—they need to be able to quickly interpret it and take action on it.

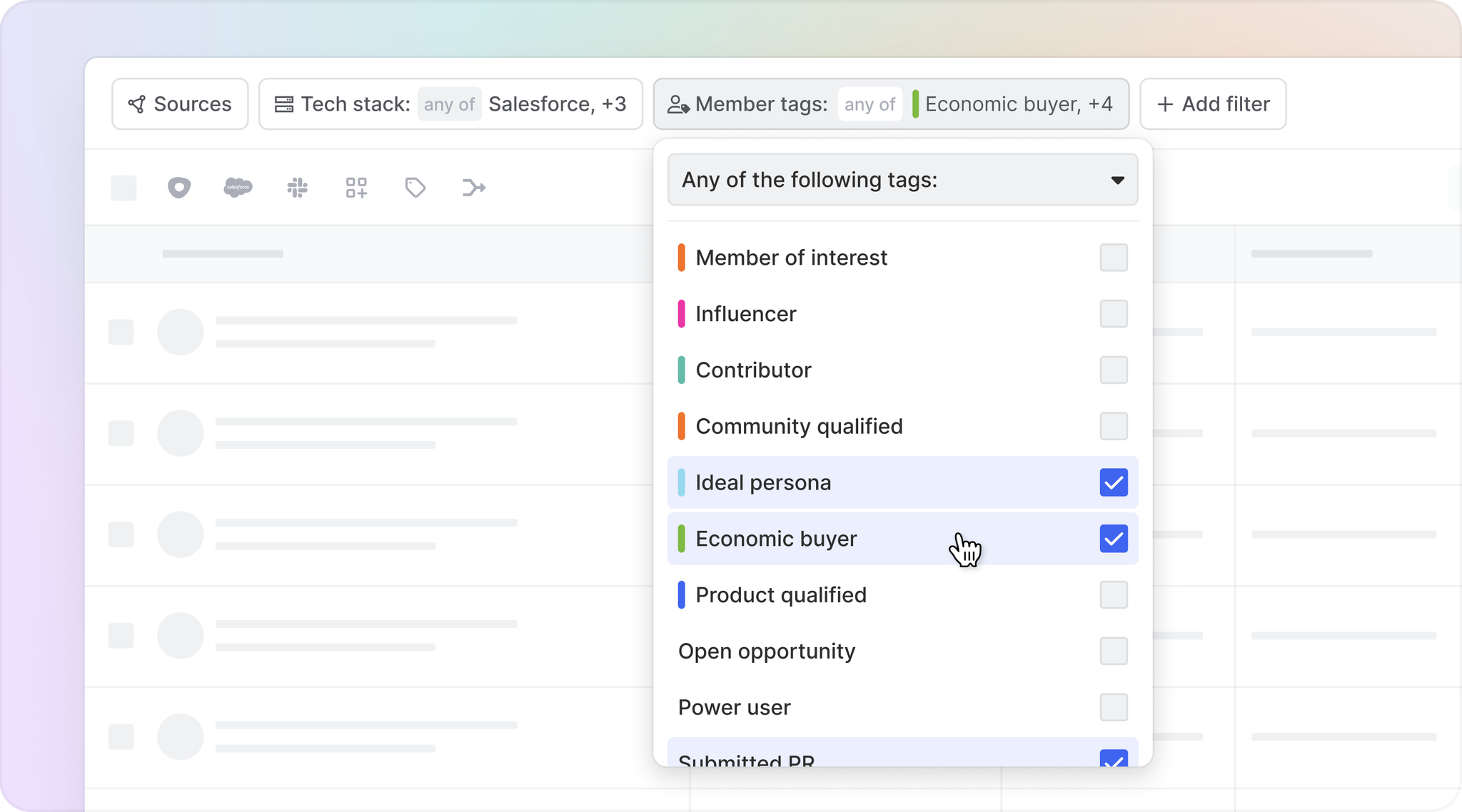

Common Room gives reps easy-to-use filters and tags so they can qualify opportunities and uncover key context fast. Sellers can zero in on recent job changes, tech stack configuration, job titles, annual revenue, ideal personas, and more with the click of a button.

Proprietary lead and account scoring algorithms surface the opportunities that are ripe for outreach (and explains why based on buyer behaviors and other contextual data). Reps can see who to reach out to and where based on their cross-channel behaviors.

🎤 "Common Room has made it easier for our SDRs and AEs to book more and better meetings. It’s our favorite sales tool here. One of our AEs called it 'my closest friend.'"

—Tyler Hayden, Director of Sales Development at Pulumi

Make buyer activity truly actionable

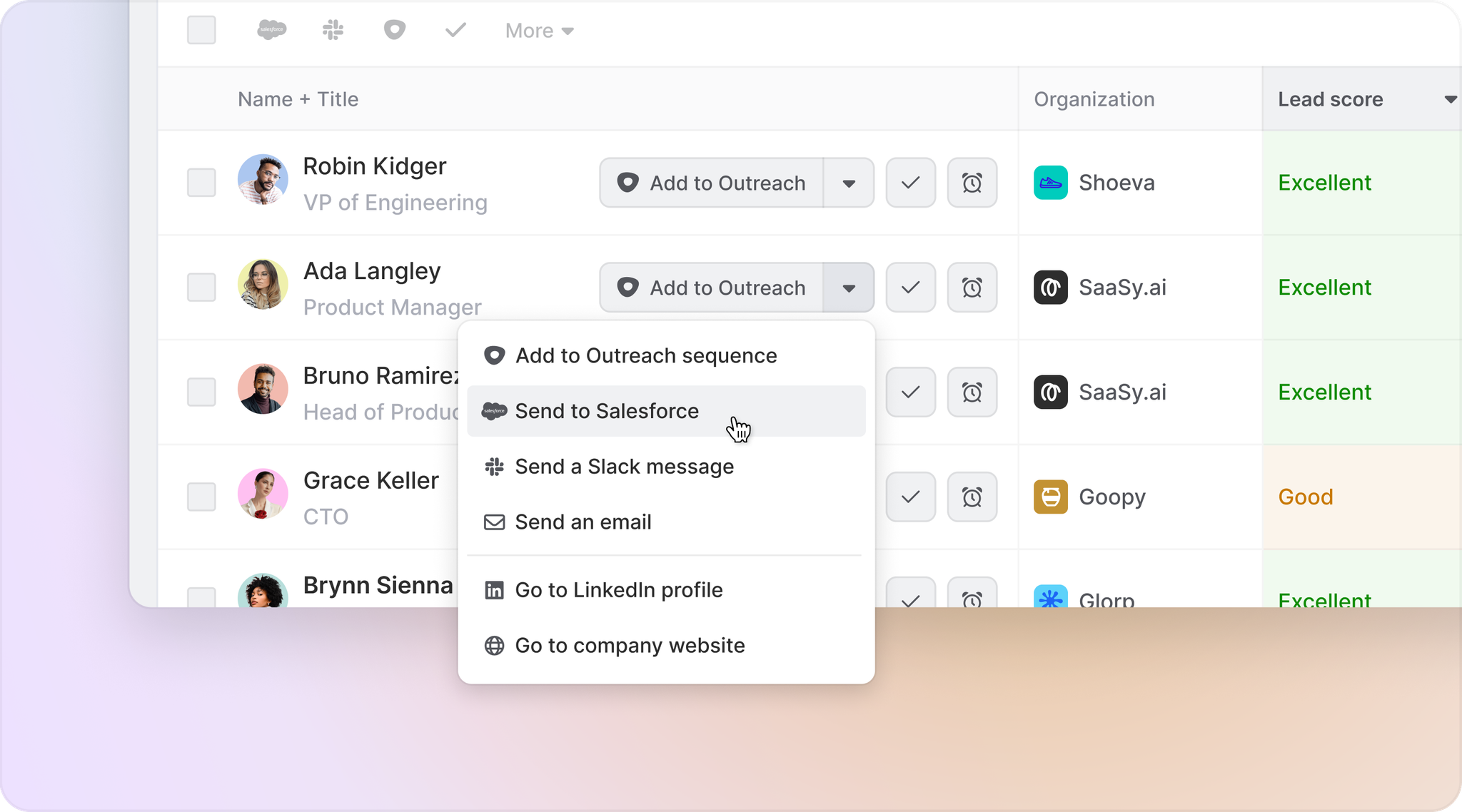

Reps need to know who to reach out to. They also need to know when and be able to move without switching back and forth between different tools.

Common Room provides sellers with customizable, real-time automations they can use to stay alerted to all buyer activity. Team alerts can be triggered and sent to sales teams directly where they work so they’re always ready to reach out at the right time.

Meanwhile, fully customizable segments allow reps to create dedicated burn-down lists where they can manage, track, and report on specific customer cohorts. Sellers can add individuals to personalized Outreach sequences, send them a Slack DM, sync their records with Salesforce, and more—all from the same place.

🎤 "Common Room made the operationalization process easy and within a few days we were off to the races. Our sales team has realized real results with meetings booked."

—Aisha Nins, Senior Sales Operations Program Manager at Apollo GraphQL

Enterprise sales is also called “complex” sales. It’s harder by definition.

But moving upmarket is a lot easier when you have the right tools at your fingertips.

Build on your product-led sales strategy with Common Room

Ready to see how Common Room helps you go beyond product-led sales?